Business Insurance in and around Saint Louis

Looking for protection for your business? Search no further than State Farm agent Mike Heidger!

No funny business here

Business Insurance At A Great Value!

Whether you own a a veterinarian, an art gallery, or a stained glass shop, State Farm has small business insurance that can help. That way, amid all the various options and decisions, you can focus on navigating the ups and downs of being a business owner.

Looking for protection for your business? Search no further than State Farm agent Mike Heidger!

No funny business here

Customizable Coverage For Your Business

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Mike Heidger. With an agent like Mike Heidger, your coverage can include great options, such as commercial liability umbrella policies, artisan and service contractors and worker’s compensation.

The right coverages can help keep your business safe. Consider getting in touch with State Farm agent Mike Heidger's office today to identify your options and get started!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

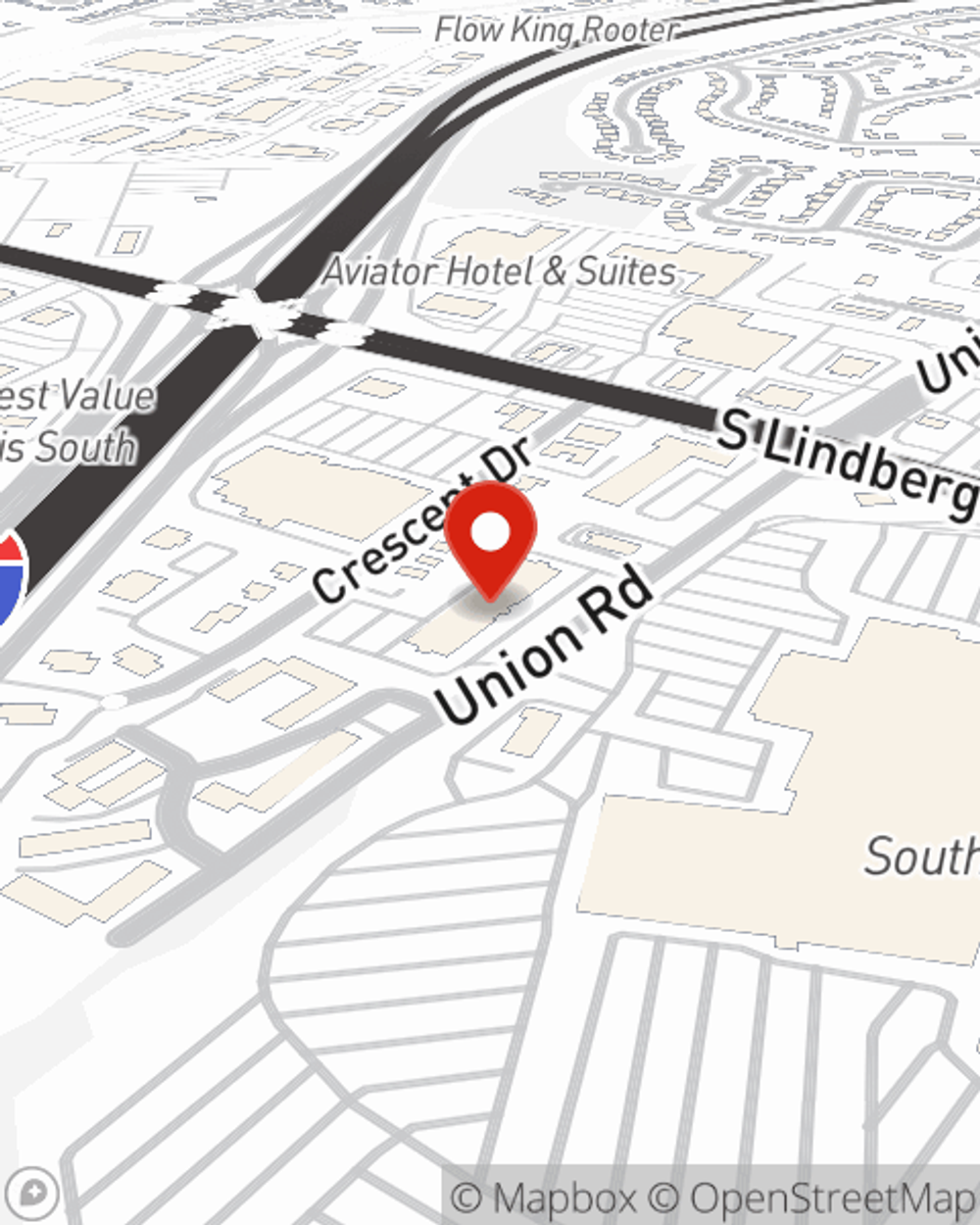

Mike Heidger

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.